Accounting for Crypto Assets: Key Concerns and Practical Guidance

Jennifer Hull

The cryptocurrency market is booming, but a lack of accounting standards poses legal and financial risk. Here’s what stakeholders need to know.

Today’s cryptocurrency market has a total capitalization exceeding $2 trillion. Major retailers like Starbucks, AT&T, and Overstock.com accept cryptocurrencies as payment. Other corporations, like Tesla and MicroStrategy, report holdings in the billions of dollars. Yet as of this writing, there are no binding accounting requirements for these digital assets.

Investors, companies, accountants, and lawmakers alike have called for them, understanding the legal and economic risk posed by not having standards—whether that involves regulatory scrutiny, audit complications, or questions from investors and analysts. Even so, no relevant US generally accepted accounting principles (GAAP) standards are in development; the Financial Accounting Standards Board (FASB) only recently put cryptocurrencies on its research agenda; and the International Accounting Standards Board (IASB) has provided limited guidance.

-

Public and private companies are charged with publishing financial statements in accordance with relevant accounting standards, such as GAAP, International Financial Reporting Standards (IFRS), or accounting standards for private enterprises (ASPE). Sometimes, such as when new financial products are developed, companies must make accounting decisions when there are no relevant standards or standards are incomplete. Other times, some guidance exists, but following the guidance produces financial information that does not reflect the asset’s value and/or the economic substance of a transaction. Assets without sufficient accounting guidance are difficult to audit, creating burdens for auditors and management. Assets without sufficient guidance also may trigger additional disclosure requirements and/or the reporting of non-GAAP measures, adding more compliance burdens on management.

For now, most companies classify their crypto holdings as indefinite-lived intangible assets, following nonauthoritative guidance form the American Institute of Certified Public Accountants (AICPA). But as the following case study demonstrates, questions and concerns arise from this current guidance. Here’s what relevant stakeholders need to know.

Key Issues with Current Cryptocurrency Accounting Guidance

Numerous companies not only invest in cryptocurrency like bitcoin, but lend, buy, and/or sell it. The accounting challenges they face under current guidance are emblematic of the obstacles stemming from a lack of standards. Below are a few key issues to watch.

Principal or agent? Inventory or intangible asset?

If a company offers a service by which customers can buy and sell bitcoin, an important distinction is whether it offers this service as principal or agent. A company acting as principal purchases the bitcoin and adds a margin before selling it to the customer. A company acting as agent arranges for one customer to provide the bitcoin to another and collects a transaction fee.

When a company is the principal in the bitcoin sale transaction, this company is holding bitcoin that has the characteristics of inventory. In other words, the company purchases bitcoin with a plan to resell them. Therefore, they have inventory risk. In the context of the airline industry, this involves the risk of unsold seats on flights. In the context of bitcoin transactions, inventory risk is the probability of not having buyers for your bitcoin inventory.

Despite these characteristics—and due to limited accounting guidance—these companies are required to account for the bitcoin they plan to resell as indefinite-lived intangible assets instead of as inventory. This classification is meaningful, because inventory has different accounting rules than intangible assets.

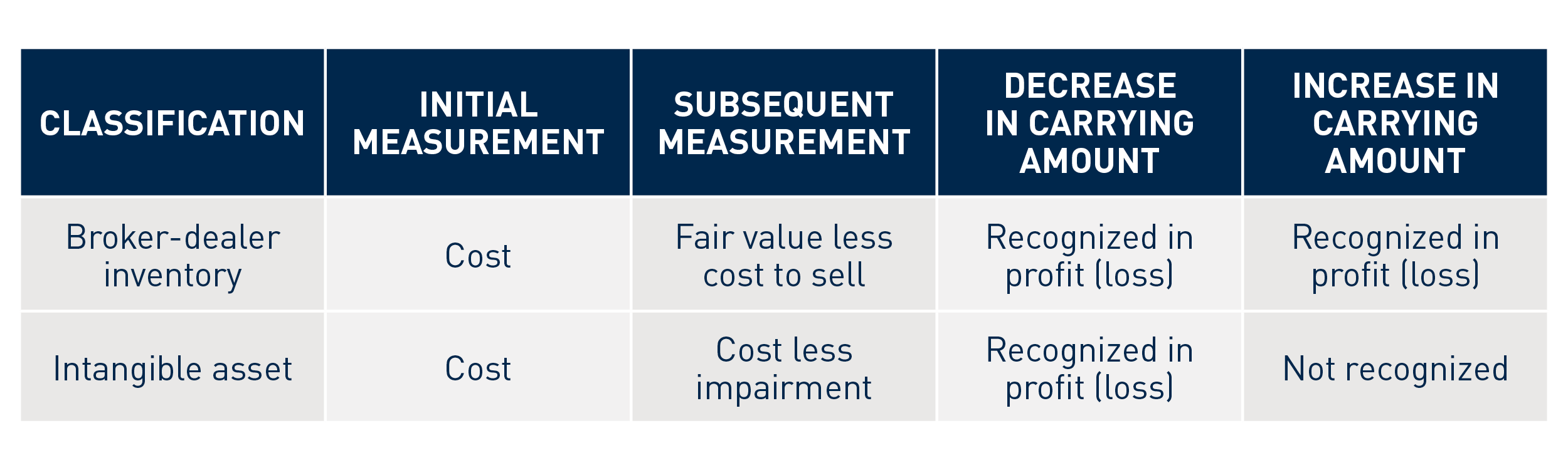

First, the classification affects the timing and character of income. For example, a broker-dealer’s inventory can be measured at fair value less cost to sell, with increases and decreases in fair value recognized in income (loss). Alternatively, intangible assets are measured at cost less impairment, with impairment charges recognized in income (loss). Impairment losses cannot be recovered until the intangible asset is sold, which specifically affects the timing of gain recognition on an income statement. The longer a reporting entity holds its impaired crypto, the longer it takes for income to reflect the true underlying economics. The table below summarizes the consequences stemming from different accounting classifications:

Second, classification affects the reporting of revenue. As principal, a company must recognize revenue on a gross basis (i.e., what the customer paid for the bitcoin) and the cost of revenue (i.e., the cost of bitcoin it purchased). If an impairment charge was taken on the bitcoin inventory, and that impairment loss was recovered—but not recognized (due to its classification as an intangible asset)—then net revenue earned in a period is inflated.

-

Crypto assets do not meet the GAAP definitions for cash or cash equivalents, financial assets, or inventory. Instead, they are classified as intangible assets, which GAAP defines as assets that lack physical substance. As such, unless a reporting entity qualifies for specialized guidance for investment companies or broker-dealers, it accounts for crypto assets as an intangible asset under Accounting Standards Codification (ASC) 350, Intangibles-Goodwill and Other. Because there is generally no limit imposed on the useful life of the crypto asset to the reporting entity, the crypto asset would be classified as an indefinite-lived intangible asset.

Fair value

Current accounting guidance means that companies that invest in bitcoin must recognize their investments as indefinite-lived intangible assets. As such, they must write down the carrying value of their bitcoin when the observable market price of bitcoin drops below that value. Further, they cannot make upward revisions for market price increases until a sale.

For instance, a company X that purchased $100 million in bitcoin in Q1 2021 might have recorded impairment charges of roughly $70 million by September 30 of that year. Yet although X recognized an impairment loss, the fair value of its bitcoin investment on September 30—based on observable market prices—was $200 million, $170 million higher than its carrying value. The table below summarizes the financial information that is useful to investors in this respect:

In sum, X’s accounting for its investment in bitcoin does not reflect the effect of bitcoin on its financial position. How does this happen? In part, because the observable market price of bitcoin is volatile. When the price of bitcoin dropped below what X had paid for it, X had to recognize an impairment charge. The price of bitcoin recovered, but X could not recognize the gain.

By contrast, if X had invested in a common stock with a volatile market price, then the company’s accounting for the investment in that stock would appropriately reflect its effect on X’s financial position. For example, the market price of Tilray, Inc.’s common stock is volatile partly because it operates in the cannabis industry. Tilray’s market cap is roughly $3.5 billion; bitcoin’s market cap is in the hundreds of billions of dollars. As such, Tilray common stock and bitcoin are both assets with observable market prices that should be used for fair value measurements. The market price of Tilray’s stock is volatile, just like the price of bitcoin.

However, if X had invested $100 million in Tilray common stock instead of in bitcoin, and Tilray’s stock price had fluctuated widely during a reporting period but translated to a $200 million fair value on a given reporting date, then X would have appropriately recognized its investment at $200 million on said date.

Therefore, X’s investment in bitcoin does not reflect the effect of bitcoin on the company’s financial position, because accounting rules for intangible assets are not suitable for investments in bitcoin.

Lending

Many companies also lend some of their bitcoin investment to third-party borrowers. However, there is no on-point accounting guidance for bitcoin-based lending transactions. This is primarily because bitcoin does not meet the GAAP definition of a non-cash financial asset: holding a unit of bitcoin does not give the holder a contractual right to receive cash, nor does the bitcoin come into existence as a result of a contractual relationship.

As such, these companies apply intangible asset accounting to the bitcoin they lend, which does not reflect the economics of these loans appropriately.

Next Steps and Practical Guidance

Though much remains to be seen regarding cryptocurrency accounting, for now those who hold digital assets must make do with what they have on hand. Here are some key principles and future-looking guidance that can help sharpen their efforts:

- Focus on additional disclosures. Companies with material holdings of crypto assets need to provide significant non-GAAP disclosures to help investors understand the economic effect of crypto assets on financial position. For example, companies may choose to disclose income measures exclusive of crypto asset impairment losses or inclusive of unrecognized gains.

- Increase reliance on non-GAAP measures. As noted above, investors must look to non-GAAP disclosures to understand the impact cryptocurrencies have on a reporting entity’s financial results. For issuers, however, there is typically heightened regulatory scrutiny on financial measures that are not calculated in accordance with GAAP. Issuers must ensure that non-GAAP measures are presented with lesser prominence to GAAP earnings, are reconciled to GAAP-based earnings, and are not misleading, among other criteria existing in SEC guidance.

- Push for fair value accounting. The types of assets addressed by GAAP rules for indefinite-lived intangible assets typically do not have a readily accessible global market like the current bitcoin and Ethereum markets. Intangible assets that are actively traded and held for investment purposes should be accounted for at fair value, and entities should be able to do so.

- Pay close attention to the FASB. In June 2021, the FASB published an “Invitation to Comment” on its standard-setting agenda, with several questions about organizations’ use of and experience with accounting for cryptocurrencies. Comments were due on September 22, 2021, and many commenters pleaded with the FASB to take up accounting for crypto assets. On December 20, the FASB published its updated technical agenda, and “Accounting for Exchange-traded Digital Assets and Commodities” was included. With the issue now on the FASB’s agenda, stakeholders should keep a close eye on upcoming developments from the FASB.